Welcome to the Weekly Wanderlust Newsletter. This week’s newsletter will include:

My US and International Rideshare guide.

My new favorite travel and points podcast.

The Rideshare Guide

I’m old enough to remember when we didn’t have rideshare apps like Uber and Lyft. I vividly remember trying to call taxis to take us to parties when I was a freshman at Penn State, and it was not nearly as convenient as calling a rideshare. These days, we don’t even think twice about calling a rideshare. In fact, I’m normally more surprised when I have trouble calling a car than when I don’t.

I think most people use rideshares instinctively, picking their favorite by convenience or name recognition (“Hey, let’s call an Uber”). Today, though, I am here to tell you that you should think about which rideshare app you use to get the most bang for your buck! I want to explore both how I think about rideshare apps in the U.S. and internationally because my “strategy” is different.

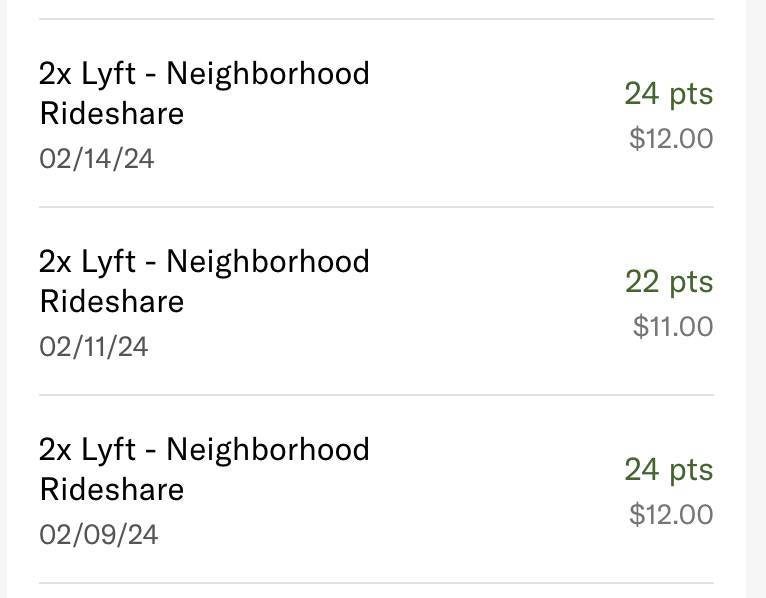

In the U.S., I am all about the points game, assuming the prices are similar across the apps and one isn’t majorly surging. As I have mentioned time and time again, I am a mega fan of my Chase credit cards. As of now, the Chase cards I have, the Sapphire, Freedom Unlimited, and Freedom Flex all get 5x points on Lyft rides through March 2025, whereas, the most I could get for Uber or Revel (or any other U.S. rideshare company) is 2x points if I used my Sapphire card (as it would be coded as travel). That’s an extra 3x points just by using Uber instead of Lyft!

Not only do I get 3 extra points through Chase, but Lyft connects with my Bilt card. Even if I don’t use my Bilt credit card to pay for my Lyft (which I wouldn’t because I would only get 2x points per dollar), linking the accounts gets me an extra 2 points per dollar spent on ANY card. This means just by taking Lyft over other companies, I get 7x points on every dollar spent.

Now, here’s the cherry on top. Once a month, if you take 3 Lyft rides and pay with a Mastercard instead of a Visa, AmEx, etc., you get a $5 credit to use toward another ride that month. My Chase Freedom Flex card, which gets me 5x Chase points + the 2x Bilt points, is a Mastercard. So, when I take 3 Lyft rides a month I not only get 7x points, but I also get $5 toward my 4th ride if I take that many rides each month. According to #girlmath, my Lyft is basically free at that point.

If I had the Chase Sapphire Reserve instead of the Preferred, I would get 10x points (for a total of 12 points per dollar with the Bilt program) on Lyft. I would have to forgo using my Mastercard and getting my $5, especially because it’s not guaranteed I will take 4 rides every month. I think it would probably be more lucrative to do so especially if I had a few expensive rides. The Reserve also gives you free a Lyft Pink membership for two years, sweetening the deal.

This works really well for Chase, but what about the other points “families” (e.g., Amex, Citi, Capital One)? I won’t get into all of them, but I will say, it’s worth looking into if you have any other cards. For example, the Amex Gold gives cardholders $10 a month toward Uber rides. If/when I add the Amex Gold to my roladex, I will use that credit first before using Lyft because it’s a use it or lose it free $10.

This is how I use rideshare apps in the U.S., but as I mentioned, I switch it up a bit when I am abroad. Unfortunately, most countries outside the U.S. don’t have Lyft, so I’m forced to use Uber or something else. However, I’m always looking for another strategy. When I travel, I google the “country or city + rideshare app” and browse the results a bit. From there, I often find sign up offers like “10% off your first three rides.” When I went to Paris in 2022 and 2023, I used an app called Bolt, and they gave me 50% off my first 10 rides. Everyone on my trip downloaded it, and it lasted us the whole time! Similarly, in Australia and Mexico City I used Didi, which gave me a small discount, as well.

Even if I can’t find a discount, I find that local rideshare companies are often cheaper than Uber AND generally have more availability if the city doesn’t have a ton of Ubers available. It’s worth taking a look when traveling abroad! Are you team Uber, Lyft, or something in between? Do you maximize your rideshare spend?

This Week’s Obsession: I’ve been really into a travel podcast called the Daily Drop Podcast recently. If you want more travel hacking than you can get here, I recommend checking it out. They recently did an episode detailing the benefit they get from their Chase Sapphire Reserve card, and I found it super helpful!

Copyright (C) Weekly Wanderlust All rights reserved.

DISCLAIMER. I'm not a certified financial planner/advisor, a certified financial analyst, an economist, a CPA, an accountant, or a lawyer. For specific information regarding your finances, please consult a professional.