*Fall*-ing for Travel

The October edit of The Departure Newsletter

Welcome to the The Departure Newsletter. This month’s newsletter will include:

The monthly Check-in

A review of my first business credit card

A Destination Spotlight on Stockholm

Some travel insights before we Take Off

Time to Check-in

Happy Fall everyone! I’m *fall*-ing in love with this weather and all the amazing travel and points news going on this time of year. It seems like everyone is talking about travel, whether traveling home for the Jewish holidays or taking their ~shoulder season~ trips. For those who look ahead, you may want to book holiday travel for Thanksgiving and Christmas time ASAP to avoid insane prices (spoiler alert, they will probably still be insane).

The thing I am most excited about right now is my points balance, there is nothing spooky about that! It’s higher than ever, coming in at around 150,000 Chase points and 35,000 Bilt points with an additional 120,000 on the horizon (more below). While I don’t have the time to use these points right now, since I just started a new job, it will only make my next vacation even sweeter (and cheaper).

Right now I am trying to enjoy the fall weather in NYC. There’s so much to do here, and Ezra and I love checking out new restaurants, comedy shows, Broadway musicals, and museums. Let me know if you have any NYC recs, but for now, let’s get into it.

I got a Business Credit Card!

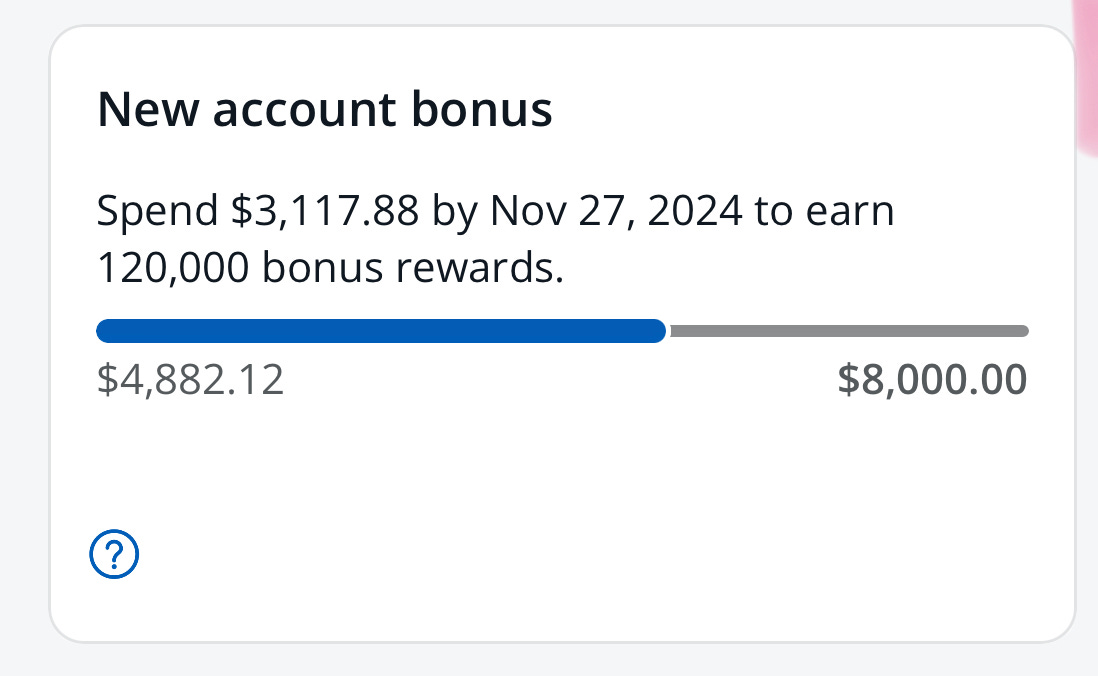

As many of you know, I love Chase credit cards. I’ve had them for years and will continue to get new ones as good opportunities arise. All that to say, in August, a good opportunity arose. Anyone who follows the Chase business cards may remember that they had an all-time high bonus offer for the Chase Ink Business Preferred card this summer. It was a 120,000-point bonus after spending $8,000 in the first three months.

When I saw that 120,000 number, I almost fainted… I mean THINK OF WHAT YOU CAN DO WITH 120,000 CHASE POINTS! I’d already been working up a points stash thanks to some referral bonuses and the 20,000 points I got when I re-signed up for the Freedom Unlimited, so I had about 100,000 points already when I applied for the card (as mentioned, I currently have more). The prospect of another 120,000 points, not including the points I’d get from meeting the spend requirement was just too much to handle.

I’ll be honest, I hemmed and hawed for a bit before I applied. For one thing, I was worried about not having a proper business. I have this newsletter with some lovely paid subscribers (shoutout to you all!), and I’ve made some money from referral links, but candidly, I’m not racking in the money writing this newsletter (yet…). In researching whether to get the card, I listened to an episode of the Daily Drop podcast (which they have seemingly taken down) and read a bunch of articles (also here), where I learned that they very broadly define who can get a business card. You don’t even need an LLC to have one. Common examples of businesses include freelance writing, babysitting, or even selling things online (hello Facebook marketplace).

From there I had to make sure I would meet the minimum spend needed to get the 120,000 points. I don’t typically spend $8,000 in 3 months for my business, but I thought hard about it before applying and realized I had some upcoming expenses that would put me over the edge. If I hadn’t had those expenses and couldn’t meet the spend, IT WOULD NOT HAVE BEEN WORTH IT TO GET THE CARD! Also, most business cards have much higher spending requirements, like $20,000 in 3 months, so while $8,000 isn’t nothing, it’s much more doable.

I’m well on my way to hitting my max, and I love the card. It earns Chase Ultimate Rewards points (the points that can be transferred and used to book travel) and can be combined with my personal credit card points (yay points). I even linked all my Chase accounts (business and personal), so I can pay the cards all on one portal (yay simplicity).

The best part about this card is that it earns 3x points per dollar up to $150,000 spent for shipping purchases, advertising purchases, internet, cable, and phone services, and travel. I quickly transferred my WiFi bill to this card to rack up those points! While this does have a $95-a-year annual fee, the 120,000 points are just too good, and FAR pays for the $95 fee. You can read some other perks of the card here. It can also always be downgraded to the $0 annual fee Ink Business Unlimited Credit Card, but right now I am going strong with this one.

Needless to say, business cards are not just for people with multi-million dollar companies, and if you can swing the annual fee and the spending requirement, they may have great perks including lucrative sign-up bonuses.

Destination: Stockholm, Sweden

During my travels to Europe in August, I ended the trip with two days in Stockholm, Sweden. You may remember from a previous newsletter that we chose Stockholm because we found a really good award flight back to the States from their airport. Since we had never visited Sweden before, we decided to make a trip out of it.

We flew from Stanstead airport in London on Ryanair into Arlanda airport in Stockholm bright and early on a Saturday, giving us two full days to explore before heading back to the States.

Stockholm far exceeded my expectations. It was a lovely, quaint, clean, and quiet city with beautiful architecture and a whole lot of sunlight (at least in the summer… a local told us in December they only had one hour of sunlight THE WHOLE MONTH). The weather was perfect, in the 70s and sunny, and there was so much to do.

We went to museums, including one dedicated to my personal favorite Swedish export, Abba (with Ikea as a close second), traveled to a tiny island off the coast of Sweden called Fjäerholmarna, drank mead at a Viking bar called Aifur, and took every opportunity to Fika (the Swedish concept of a daily break for connection and rest typically over a pastry and coffee). I think 2 days was the perfect amount of time in Stockholm, and I would highly recommend tacking it onto your next European getaway, especially if you can find a cheap flight! If you are interested in visiting, you can find my whole itinerary here!

Before We Take-Off…

Check out some exciting things going on this month:

Monthly To-Do:

Take a look at Daily Drop’s best credit cards list for October (P.S. — the Chase Sapphire Prefered has ANOTHER amazing signup bonus) and their October transfer bonus list.

Review the Points Guy’s October Monthly Checklist to make sure you are maximizing your sign-ups, transfers, and credits.

If you are planning to fly to Europe or beyond this month, see if any Flying Blue monthly award savings meet your needs.

Hawaiian Airlines and Alaska Airlines recently merged, and it may bring joyous points redemptions your way!

Chase has a targeted offer for up to 20,000 bonus points when booking with Chase Travel. See if you qualify here.

Time for me to Take-off! I will see you all next month.

Happy Traveling,

Jess

Copyright (C) The Departure All rights reserved.

DISCLAIMER. I'm not a certified financial planner/advisor, a certified financial analyst, an economist, a CPA, or an accountant. While I hold a J.D., I am not yet licensed to practice law, and I am not your lawyer. For specific information regarding your finances, please consult a professional.